life insurance with living benefits quotes

living benefits life insurance young

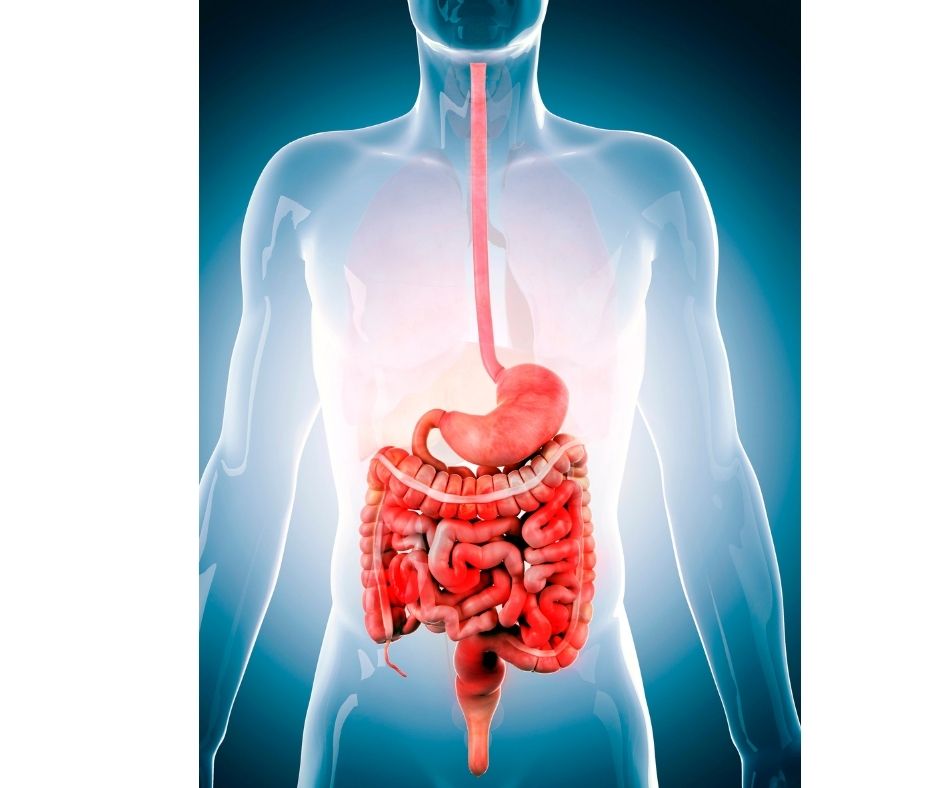

It covers qualified critical diseases with high medical costs and shortened lifespans, such as stroke, heart attack, kidney failure, heart attack, life-threatening illness, and heart attack.

Living benefits, often added to your life insurance policy, allow you to receive some of the death benefits when you are still alive.

You can withdraw your policy proceeds from life insurance that includes living benefits. The proceeds can be used for any purpose. These are often referred to as living benefit riders or accelerated mortality benefit riders.